Getting Out of Debt: DIY

If you are overwhelmed with debt, now is the perfect time to take some action and take control of your financial situation. It may not be easy and it may take several months or even years to accomplish, but it will be well worth it once you are debt-free.While there are many agencies promising to help you get out of debt, there really is no reason why you cannot take the necessary steps today and pull yourself out of debt on your own.

If you are overwhelmed with debt, now is the perfect time to take some action and take control of your financial situation. It may not be easy and it may take several months or even years to accomplish, but it will be well worth it once you are debt-free.While there are many agencies promising to help you get out of debt, there really is no reason why you cannot take the necessary steps today and pull yourself out of debt on your own.

Below are some helpful tips to help you start on the track to getting out of debt, so that you can start living debt-free.

Create a List of Your Debt

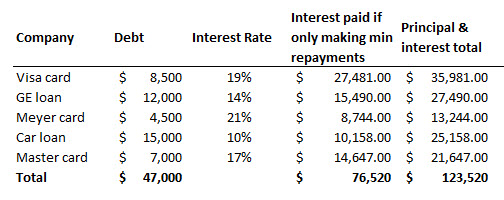

Before you make any decisions about how to start paying off your debt, it is important to completely understand the details of your debt – guess work and assumptions won’t cut it. A great way to create a plan and motivation is to put together an overview of your debt which can include: your outstanding balances, interest rates, interest you would have to pay back if you only make minimum repayments and the total repayment amount of principal and interest if you were to only make minimum repayments – it will be an eye opener!

This will help you determine which loans to pay off first and which ones can wait until a little later. It will also give you an idea of just how much debt you owe and about how long it may take you to pay it off.

Creating a budget in addition to the above is the best way to outline your total financial situation. It will highlight spending habits and points of waste and opportunity which can be used to keep you from going into further debt and assist you in getting out of debt quicker.

Example of a basic debt overview:

Quick take on the debt overview: You can clearly see the costs associated with borrowing $47,000 to the tune of $123,520 in total if you only make the minimum repayments. A chart like this provides viability on which debts you should prioritise paying off first – See Debt Snowballing below

The above was created using the DealingWithDebt credit card calculator. This tool also has some advanced features which can show you how much quicker you can get out of debt along with how much interest you can save by increasing your monthly repayments.

Extra Money on Debt

Getting out of debt takes a strong commitment on your part. You must first make the decision to stop incurring more debt, which means no more loans and no more using any credit cards, unless it is an absolute emergency. In addition, you will have to look at your household budget and determine where you are able to cut back on some of your expenses. This may require a slight adjustment to your current lifestyle, but it will be worth it in the end.

Consider cutting back on how much money you spend on entertainment and rent movies instead of going to the movie theatre, or cancel your summer holiday and go in a few years when you have money available. In addition, you can cut back on how often you eat out at restaurants, and decide to eat at home instead. There are literally dozens of different things you can do to cut back on your current expenses. You can use this extra money to pay down some of your outstanding debt.

Refer to your budget to identify areas of savings and make the necessary adjustment to your spending habits – then apply these savings to your debts. Use the before mentioned calculator to see how adding new savings toward debt will speed up the process and save you cash in the long run.

Select a Debt to Pay

A great strategy to get out of debt is to focus on one main debt at a time. Your first step is to determine which debt you want to pay off quickest. Most people either select the debt that has the highest interest rate or the debt with the smallest outstanding balance. If you choose the debt with the highest interest rate, you are likely to spend less money in interest expense over time. However, choosing the debt with the smallest balance is often more manageable for many people. Attacking the debt with the smallest balance first is called snowballing.

– What is snowballing?

You must pay the minimum balance on all of your debts, but pay any extra money you have available on the one debt that you selected to pay off first. This will help you pay this debt off at a faster rate. Keep in mind that the more money you have available to pay towards your debt, the faster you will get to the point where you are debt-free and can start saving for the things you really want.

Once you pay the first bill off completely, you can start working on the next bill on your list. As you pay off one debt, you can use that additional money to help you pay off the other debts faster. Working on just one debt at a time is a very efficient and effective way to reduce your overall debt quicker.